Legal or Ill(egal)?

Legal or Ill(egal)?

Legal or Ill(egal)?

Legal or Ill(egal)?

16. Mai 2024

Feedback: 0

Hola, dear friends of relaxed relocation! In the previous post, we already talked about our successful house hunt. Now we’re one step further and can finally announce whether we can buy our dream property or if our lawyer has concerns or even advises against it because the house wasn’t built legally.

What’s happened so far

We signed the reservation contract with the real estate agent and made a deposit of €1,000. Next, the real estate agent gathered the remaining documents and forwarded the existing ones to our lawyer for review. These documents include things like:

◉ Land registry extract

◉ Property cadastral information

◉ Building permit

◉ Possible outstanding property tax (IBI)

◉ And much more…

After receiving all the documents, our lawyer planned a brief conversation with the planning office to validate everything. After consulting with the planning office, our lawyer was finally able to give us the “green light” to proceed with the purchase. Everything is legal, and we can continue with the buying process.

Shortly after, we received the private preliminary contract, which had already been signed by the sellers. This contract stipulated a down payment of 10% of the purchase price and a deadline of 70 days for the notary appointment, though this timeline could vary. Additionally, the contract covered various aspects, such as the condition of the house at the time of sale or a penalty clause stating that, in case of withdrawal, the seller must refund double the deposit to the buyer, while the buyer forfeits their deposit.

Standard

Our lawyer confirmed that this is standard practice. The seller is also required to present documents like the energy certificate, the latest bill from the local government, and a receipt for payments made to the water utility at the notary appointment. The contract also specifies whether the house is being sold with or without furniture. Typically, sellers in Spain include furniture when selling used properties. If you don’t want the furniture, it should be stated in the contract. In our case, the furniture didn’t quite match our taste. There were two or three nice pieces, but mostly it was an “all or nothing” deal. So, we opted for an empty house. Besides, we already have some furniture in a container in Germany.

Money for Keys

What initially seemed simple turned out to be quite complex. Since we are paying the full purchase price from our own funds and don’t need to apply for bank financing, we thought the payment would be relatively straightforward—thanks to SEPA. Unfortunately, that’s not the case. In Spain, the purchase price is paid directly at the notary appointment, usually via bank check, which means the buyer must have an account with a Spanish bank. To buy a house in Spain or open a bank account, you generally need the N.I.E.. Our lawyer found a good solution by setting up an escrow account for us, so we no longer felt the pressure to quickly open a bank account and transfer the money. We’ll explain why this whole ordeal exists further down.

Now we just have to wait until the sellers have vacated the house before we can schedule the notary appointment.

Real estate purchase – N.I.E. or just N.I.F.?

When you want to buy property in Spain, you’ll eventually hear about the so-called N.I.E.. You often read that foreigners are required to have an N.I.E. to buy property. Technically, this isn’t entirely true. But what is the N.I.E., anyway? The N.I.E. (Número de Identidad de Extranjero) is simply an identification number for foreigners in Spain, and it’s required for all legal transactions. Without an N.I.E., for example, you can’t rent an apartment, get a cell phone contract, open a bank account, buy insurance, work or study, and much more. Spanish citizens also have an identification number, but theirs is found in the D.N.I. (Documento Nacional de Identidad), the Spanish ID card.

Of course, the government wants its share in the form of taxes when you buy property. That’s why you need a Spanish tax number (Número de Identificación Fiscal – N.I.F.). Every year, the property tax (Impuesto sobre Bienes Inmuebles – IBI) is due. By the way, this tax isn’t automatically debited from your account like in Germany, nor is a payment request sent. The owner is responsible for making sure the property tax is paid. How much the tax is and when it’s due must also be confirmed by the owner with their local government.

Which Version Should It Be?

To get back to the N.I.E., for foreigners, this number corresponds to the N.I.F., but not the other way around. This means that if you have a foreigner identification number (N.I.E.), you also automatically have a tax number (N.I.F.). However, if you have a tax number (N.I.F.), you don’t automatically have a foreigner identification number (N.I.E.). Technically, to buy property, you only need a tax number in addition to the money. Since late 2022, this tax number can be applied for directly and legally at the notary. Before, this wasn’t possible, and you had to apply through the tax office. This option makes it easier for foreign investors who aren’t residents of Spain and don’t plan to be to invest in the Spanish real estate market.

For Spanish citizens, the N.I.F. corresponds to the number in their D.N.I. For businesses and the self-employed, there’s the C.I.F. (Código de Identificación Fiscal), which must be applied for separately.

According to our lawyer, it’s very difficult to get an appointment at the foreigners’ office to apply for an N.I.E. The post on parainmigrantes.info even mentions a black market for appointments at various offices. Bots scour the appointment scheduling websites and book every available slot. Additionally, there are now many companies that help foreigners obtain an N.I.E. for a fee. These companies advertise fast processing. The question is how these companies can promise legal and quick processing when no appointments are available. This suggests that these companies either purchase appointments on the black market or may even run the market themselves.

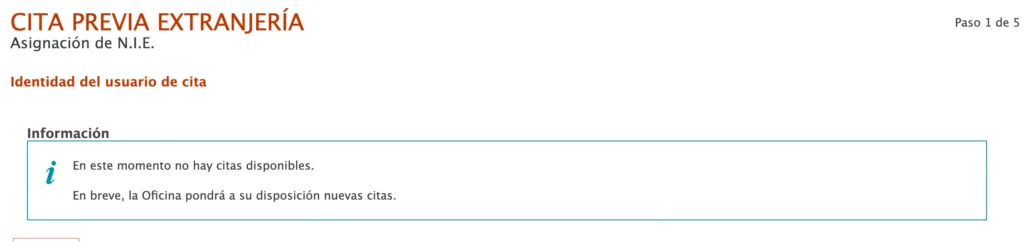

Cita Previa Extranjeria

No matter the time of day or night, the same situation occurs:

To complete the property purchase as quickly as possible, we decided to apply for the tax number at the notary and deal with the residencia and N.I.E. later. ¡Hasta pronto!

Wir sind zwei deutsche Auswanderer und auf emigres-life nehmen wir Dich mit auf unsere Reise in ein neues Leben.

In unserem Projekt schwingt das Pendel meist in Richtung stressig oder chaotisch und weniger in Richtung tiefenentspannt.

Wenn du also wissen willst, in welches Fettnäpfchen wir als nächstes treten oder welche Hürden vor uns liegen und wie wir sie überwinden, dann bleib dran.

Pin it!

Pin it!